Bitcoin price falls under $62K amid wavering spot BTC ETF demand

Bitcoin fell 3% on April 16 as crypto investors entered a risk-off mode amid stagnating ETF demand.

Data from Cointelegraph Markets Pro and TradingView showed local BTC price lows of $61,709 on Binance shortly after the Wall Street open on April 16.

Bitcoin joined U.S. stock indexes in heading lower on the day, as the U.S. dollar Index reached a six-month-high of 106.17.

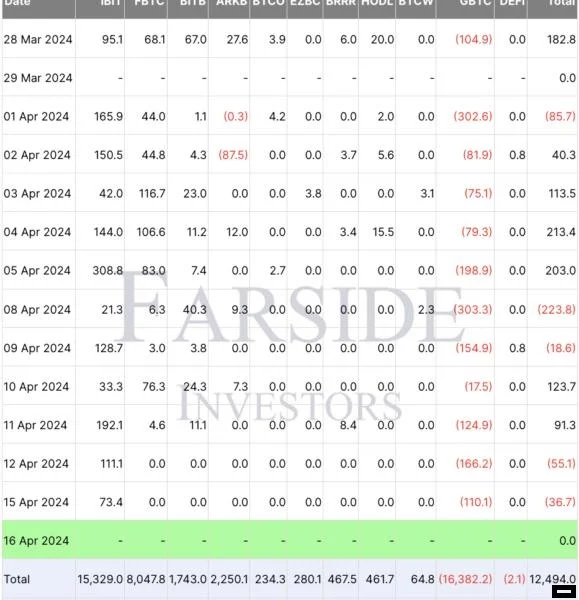

On april 15, capital flows into the spot Bitcoin exchange-traded funds (ETFs) recorded $36.7 million in net outflows, according to data from Farside Investors.

“Bitcoin ETF demand has stagnated for 4 weeks,” the founder and CEO of CryptoQuant Ki Young Ju

Placing emphasis on the slowing inflows into the spot Bitcoin ETFs, Farside Investors data revealed that only Grayscale and BlackRock have had flows on Friday, April 12 and Monday, April 15, as every other fund recorded zero flows.

The latest report by CryptoQuant also reveals that demand growth for Bitcoin from ETFs in the U.S. has slowed down.

“Demand from ETFs (blue line) has also slowed down significantly from its March peak.”

Meanwhile, an earlier report by Cointelegraph revealed that Bitcoin whales were holding onto their coins despite the recent ongoing drawdown in BTC price.

Young Ju’s observations corroborate this, showing that accumulation has increased despite the tapering spot Bitcoin flows.

“On-chain accumulation remains very active, even when excluding ETF settlement transactions.”

The news on spot Bitcoin ETF approval in Hong Kong failed to spark a pre-halving rally in BTC price.

Boxmining founder Michael Gu said HK spot Bitcoin ETFs “serves as a testbed for China money to enter the system.”

BTC price needs to consolidate before new all-time highs

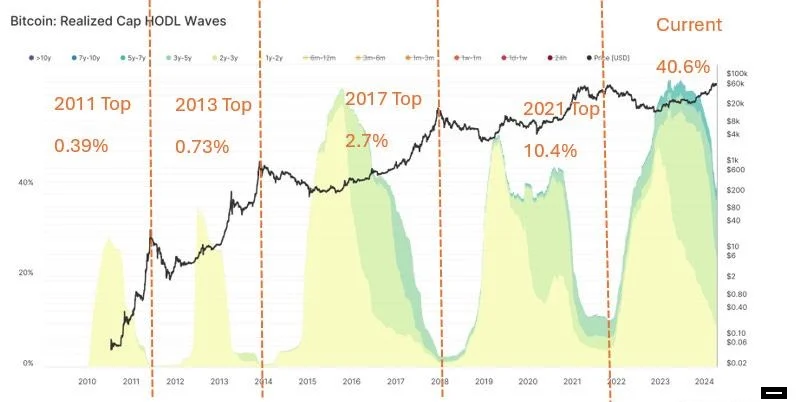

Analyzing the current Bitcoin market structure, crypto analyst and partner at MV Capital Tom Dunleavy noted that the percentage of realized value of long-term holders was over 40%, way above the 10% that has historically defined BTC tops.

“With a number of continued catalysts (Halving, further ETF flows, BTC L2s), we think there is no reason to suspect a near-term sustained pullback. Full speed ahead to $150k by early 2025.”

While remaining optimistic, position trader Bob Loukas examined a number of indicators on the daily chart as grounds to suspect a consolidation of the BTC price over the next two months before making a convincing run into price discovery.

CryptoQuant analysts added,

“Investors have reduced their exposure to BTC ahead of this week’s Bitcoin halving (expected by April 20) and could be waiting on the sidelines for the situation in the Middle East to deescalate.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.