Bitwise’s amended Ethereum ETH filing says Pantera interested in $100M buy

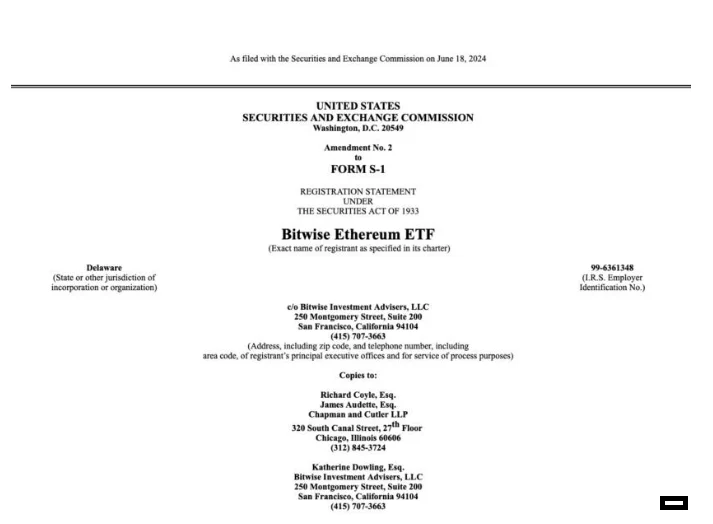

Asset management firm Btwise revised its spot Ether exchange-traded fund (ETF) Form S-1 registration statement, which inclued a potential $100 milion investment in the ETF upon its trading launch.

Bitwise’s June 18 filing with the United States Securities and Exchange Commission(SEC) said investment firm Pantera Capital Management “has indicated an interest in purchasing an aggregate of up to $100 million of Shares” in the Ether ETF.

“However, because indications of interest are not binding agreements or commitments to purchase, these potential purchasers could determine to purchase more, fewer or no Shares,” the filing said.

A Form S-1 is a document submitted to the SEC before a security starts trading that includes information on financiaals, operation and risk analysis.

The filing are the final part of an approval process before the spot Ether ETFs are allowed to be publicly traded, and event that SEC chair Gary Gensler believes will happen “sometime over the course of this summer.”

On May 23, the SEC approved 19b-4 filings from eight Ether ETF bidders, but the applications require Form S-1 approvals before the ETFs can begin trading on U.S. exchanges.