Divergence types (3)

1.Hidden divergence often appear after regular divergences appear.

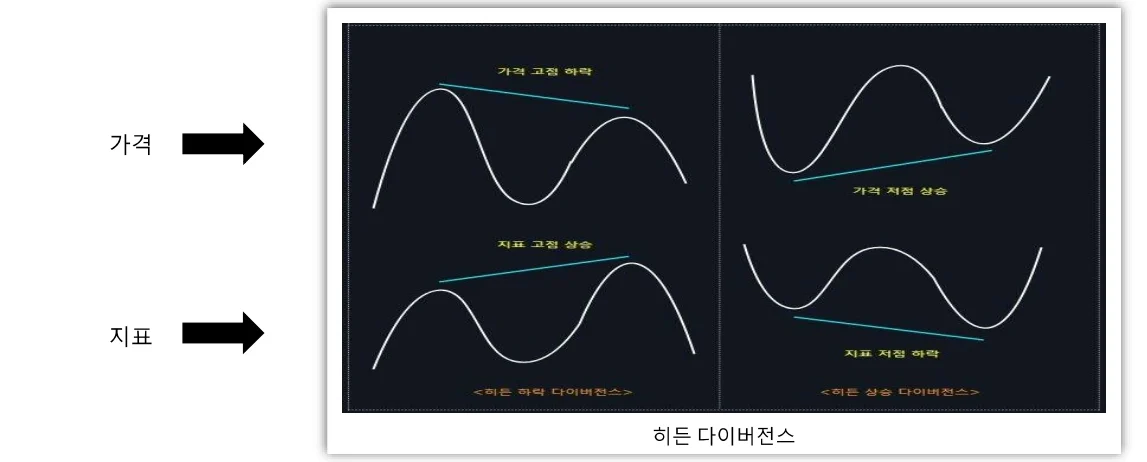

2.In this case, it is kwon that hidden divergence is given priority. For example, if a double bottom is made in a falling market and an upward divergence is created, an upward reversal can be expected, but there are cases where a downward divergence is are cases where a downward divergence is created at a subsequent high point.

3.This means that although the indicator is rising, the price peak has fallen, and the upward divergence has fallen, and the upward divengence has already ended by making a peakm creating a downtrend where the peak falls, meaning the continuatuon of the downward trend.

4.In other words, hidden divergence usally appears after a general divergence, and at this time, it means that the general divergence break has ended, so it means that it is a continuation of the existing divergence.

The content of the divergence is an explanation of the divergence that will be commonly used in thecators that will be introduced later, so you can come back and check it when the relevant content appears in the indicator.