MACD definition and meaning 2

Qualitative Definition

1.MACD is the value obtained by subtracting the long-term moving average from the short-term moving average and indicates the degree of convergence and divergence of the short-term and long-term moving averages.

2.The short-term and long-term moving averages repeat convergence and divergence, and when divergence occurs, the absolute value of MACD will increase, and if it converges, it will converge to a value close to 0. therefore, MACD will rise and fall based on 0.

3.As the short-term moving average breaks upward from the long-term moving average and the uptrend becomes stronger, MACD will become positive, and as the short-term moving average breaks above the long-term moving average and the downtrend becomes stronger, the absolute value will become negative and the absolute value will increase.

4.MACD itself alone can show the degree of convergence and divergence of the short-and long-term moving averages, but by calculating the oscillator minus the signal, the trend change in the degree of convergence and divergence is calculated.

5.In other words, by removing MACD’s short-term average and short-term trend signals from MACD, the oscillator indicates the trend strength of the short-term and long-term separation of stock prices.

6.In other words, when the oscillator breaks and decreases, it does not mean that the short-and long-term separation decreases, but rather that the separation increases (MACD increases) but the increasing trend slows down.

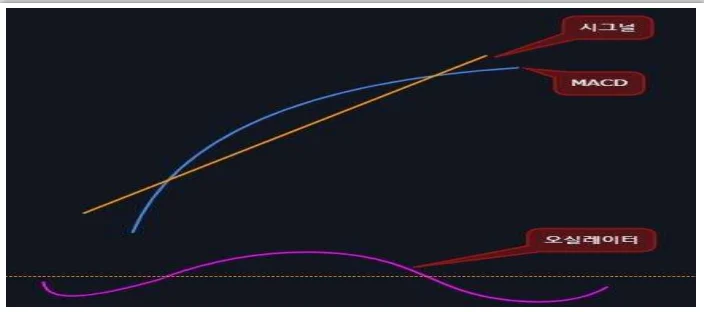

7.To explain this process with a picture, in the picture MACD is continuously increasing.

8.This means that the short- and long-term gap continues to increase, which means that stock prices are continuously on an upward trend.

9.However, from the moment the oscillator makes a high point and breaks, the short – and long-term separation increases, but the degree of increase slows down, which means that the increasing trend of the short – and long-term separation is broken.

10.In addition, when the MACD breaks below the signal, the oscillator forms a dead cross and has a negative value. this means that the degree of separation between that the degree of separation between the short and long term is lower than the existing trend and long term is lower than the existing trend, so the short-term moving average may soon dead cross the long-term moving average.

To summarize

1.MACD: Separation of short – and long-term moving averages, difference signal: MACD’s short-term trend

2.Oscillator: It can be said to be the degree of increase in the separation of the short – and long-term moving averages.