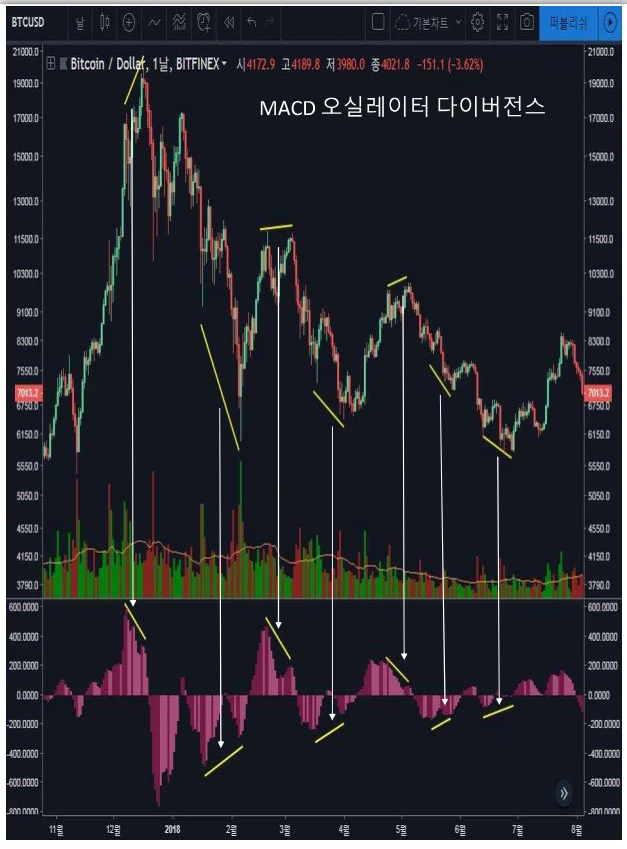

MACD Divergence

The most proactive tool, divergence

The signals described above only show the extent of the current trend and are difficult to use as signals of a trend change.

Divergence is when the changes in the high and low points of the market and the changes in the high and low points of the indicator move in opposite directions. when the change in the degree of separation form the short – and long – term moving average runs counter to the change in the price.

In other words, there is a possibillity that the trend will reverse in the future because it occurs at a point where the degree of increase in the current trend decreases.

However, even if the trend slows down, it does not necessarily guarantee a trend reversal and ultimately depends on supply and demand.

However, before a trend is reversed, there is always a process of slowing down the existing trend, so if a divergence occurs, the possibility of a trend reversal must be kept in mind.

Please check the picture to see if there is a trend reversal after the divergence occurs.

Persinally, along with RSI, divergence is the indicator I refer to the most.

Although it is slightly less reliable than RSI, the MACD oscillator often gives divergence when RSI does not, so it is important to note.