Instructions on how to trade futures on the BingX exchange!

Hello everyone!

This time, I will guide you step by step on how to trade futures on the BingX exchange, so that those who have never tried coin futures trading can easily do so.

Anyone can easily trade futures if they read this article carefully!!!

I’ve explained a lot about the BingX exchange so far, so you can just trust it and follow along~~

If you have not yet registered, please click the link below to go to the registration instructions, sign up first, and then follow the instructions.

If you click the link below and follow the instructions to sign up, you can receive both new sign-up events and commission payback benefits.

If you have completed signing up, just follow the instructions below!

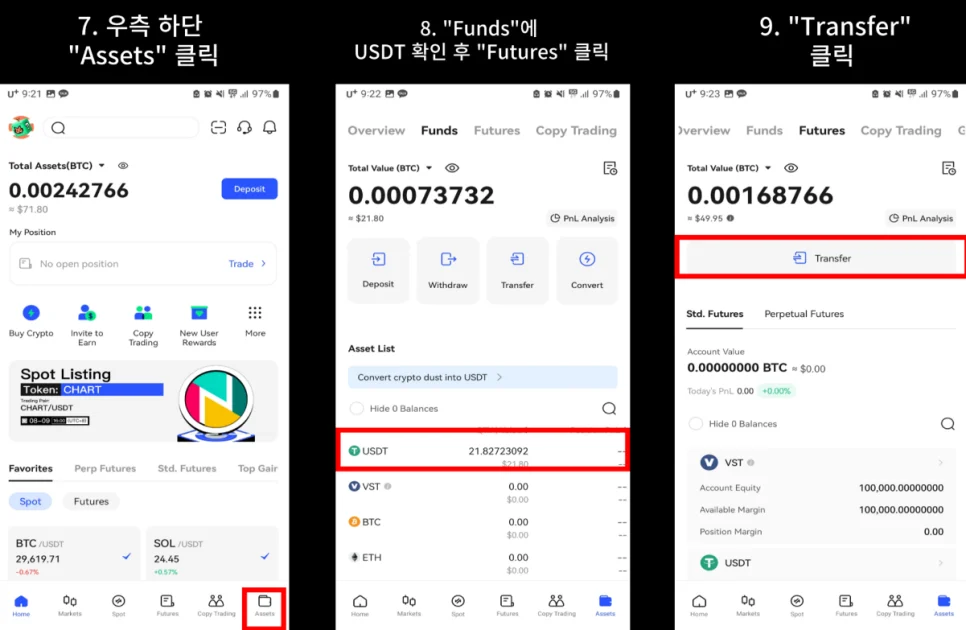

Clip “Assets” once more.

Check USDT in “Funds” and click “Futures”.

Click “Transfer” to get ready to convert spot dollars to futures dollars.

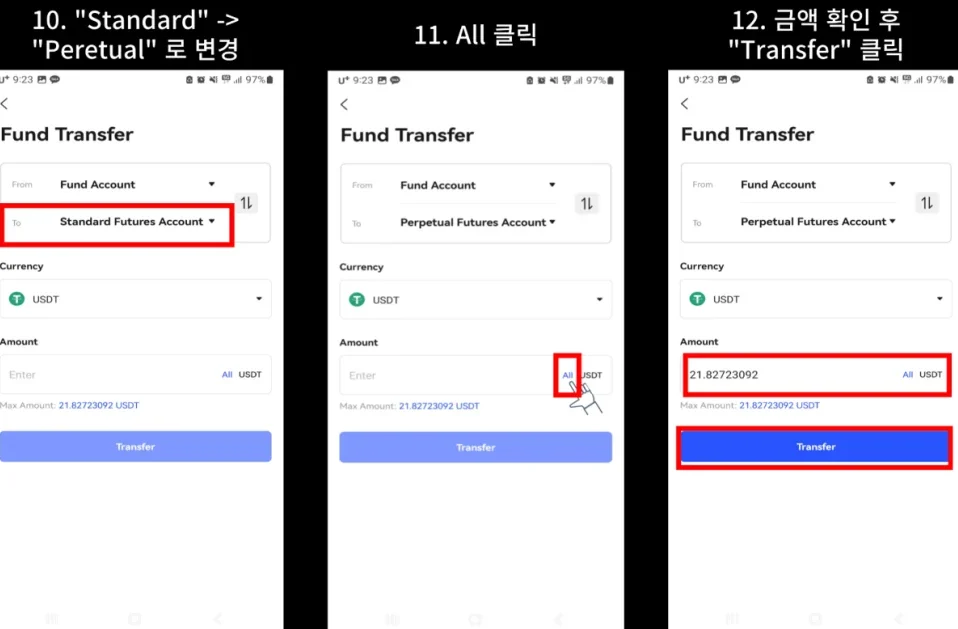

Just change “Standard” to “Perpetual”.

Click the All button on the center right.

After confirming the amount, click “Transfer” to complete the conversion.

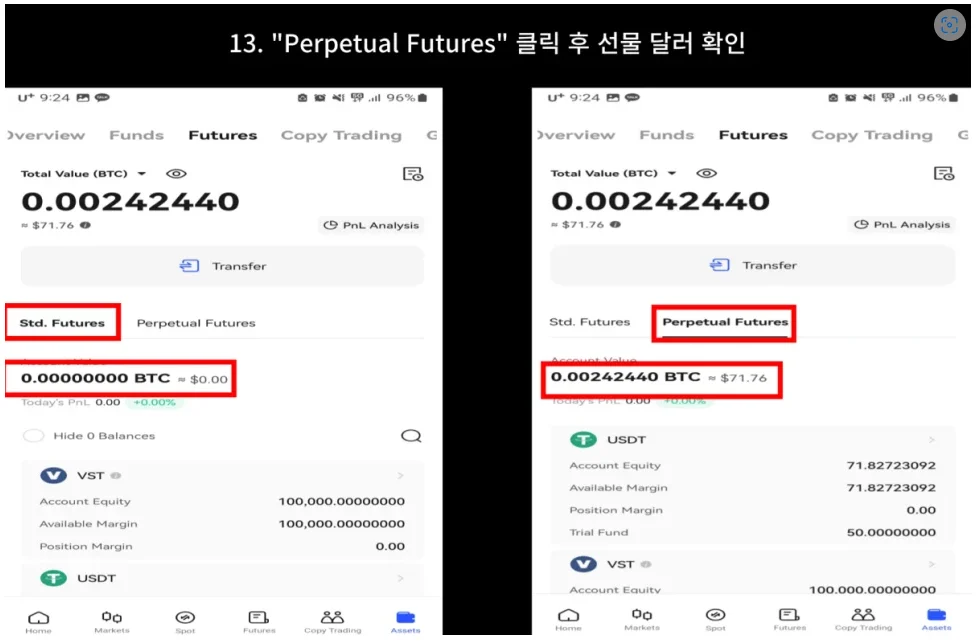

Click “Perpetual Futures” to confirm that the futures dollar conversion has been completed.

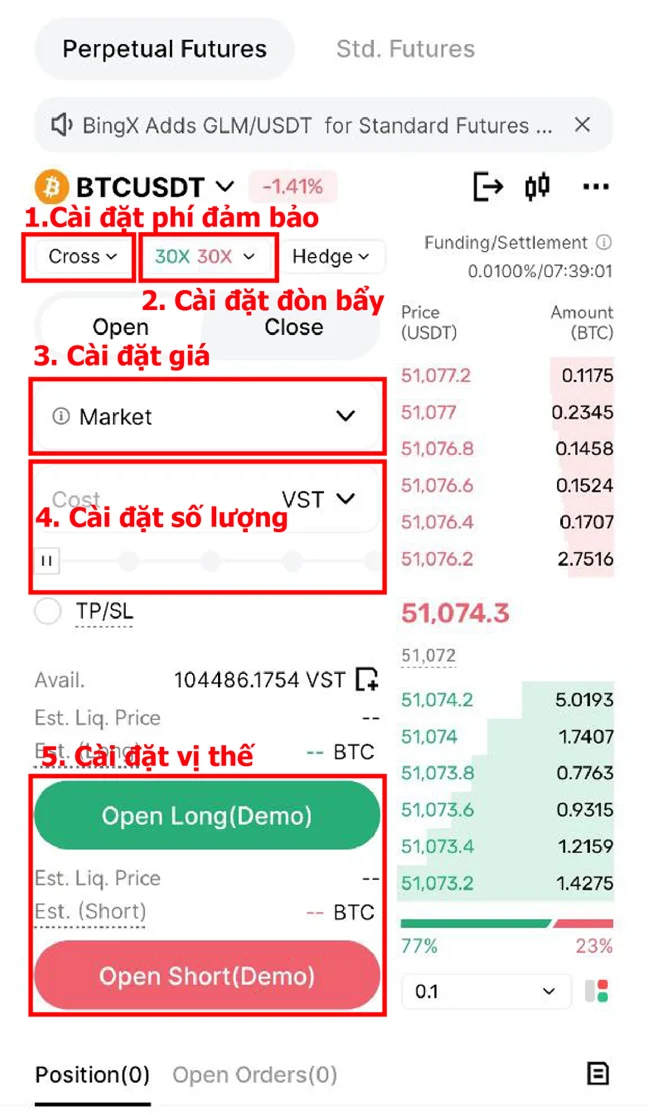

First, you need to know what the buttons above are.

Just set them one by one in order from 1 to 5!

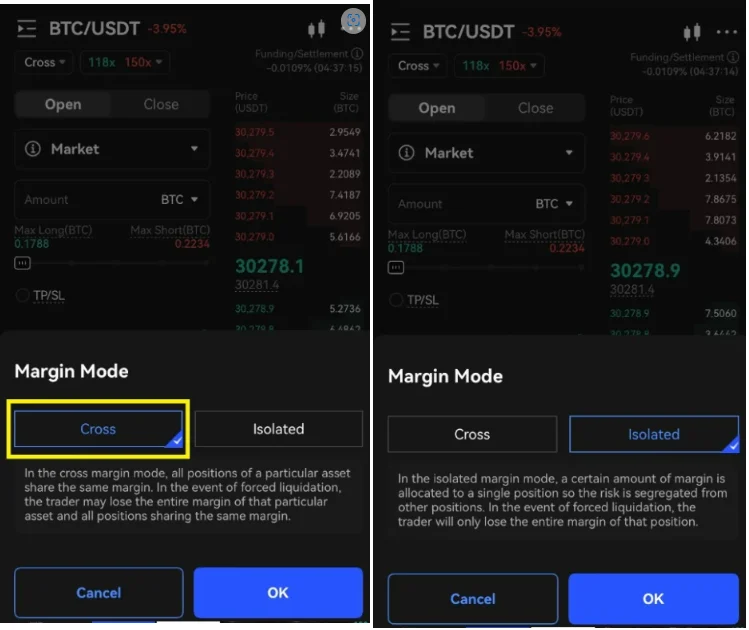

1.Set margin

There are two margin methods, just choose one.

Cross is a method in which the entire balance is captured in the margin. It may result in greater losses or losses, but it can lower the likelihood of liquidation.

Isolation is an isolation method that keeps the margin and balance separate. The likelihood of being liquidated is higher than with crosses, but losses can be reduced when liquidated. I mainly use the isolation method.

2. Leverage settings

The advantage of BingX Exchange is that the leverage can be set quite high. Exchanges such as Binance and Bybit have a maximum leverage of 100x, but you can use a higher leverage of 150x.

This means that you can trade 150 million won with 1 million won.

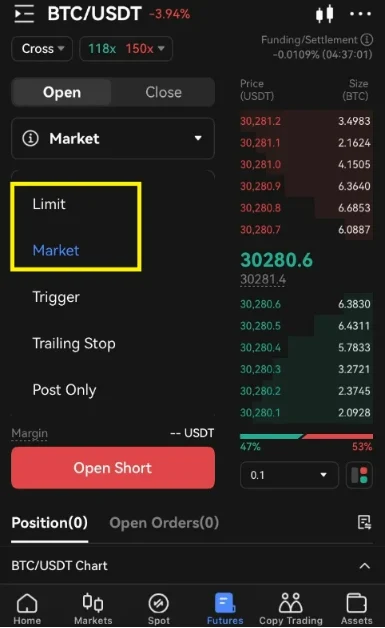

3. Price setting

There are several price ordering methods, but it is enough to know only “limit price” and “market price” trading.

There are other conditional spells, but you can learn them gradually.

In general, I use “Market”, which is a market order.

You can use it according to your individual inclinations, but it is a method that responds quickly and is used by many people.

4. Quantity setting

You can set the quantity as much as you want within the amount you have.

We recommend practicing with a small amount at first.

5. Position setting

Now all I have to do is decide which position I want to enter.

Open Long if you expect the price to rise

Open Short if you expect a price drop

If you click like this, you will see that you have entered the position. After entering a position, you will incur a profit if the price of the coin moves in the direction you expect, and a loss if it moves in the opposite direction.

And because leverage is used, you will see more profits or more losses compared to the actual coin price movement. Now you can trade slowly and practice.

In addition, I am operating a “Free Guide to Coin Futures Trading” channel so that even beginners can easily follow along. If you would like to follow along, please click the link below and refer to the instructions.