Use of Bollinger Bands (1)

● Trading box notes using Bollinger Bands

1.The first thing I will talk about when using Bollinger Bands is their use in box ticket trading.

2.It’s very simple. In the section where stock prices move within the range, volatility remains constant, so the thickness of the Bollinger Band also remains constant.

3.At this time, the stock price moves between the upper and lower ends of the Bollinger Band. In that case, you can adopt a stratefy of buying at the bottom of the Bollinger Band and selling at the top.

● Things to note

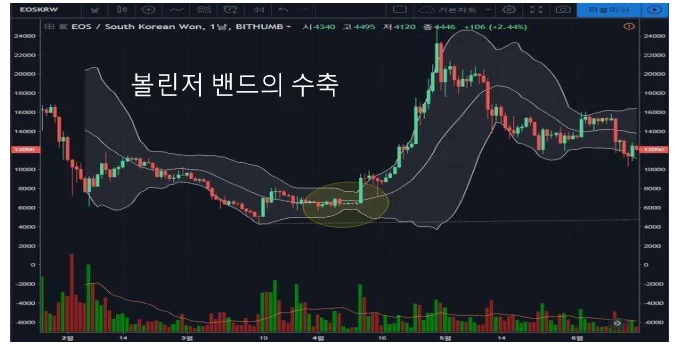

If you move sideways in the box range, the Bollinger Bands will open upward of downward at some point, so you must always be careful. Bollinger Band contraction, a precursor to a market explosion.

● Due to mean reversion, reduced volatility is bound to increase again at some point.

1.Due to mean reversion, reduced volatility is bound to increase again at some point.

2.If the volatility of the stock price decreases, that is, when the ball ban contracts and the stock prices moves sideways, caution is required as there may be a price eruption later.

3.In particular, if the ball ban contracts at the bottom as shown in the photo, shooting upwards may follow, so it is necessary to kepp an eye on it.

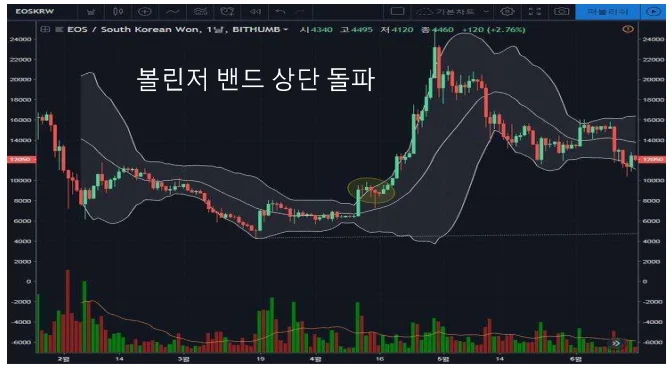

● Breaks through the upper Bollinger Band, triggers buy.

1.After the contraction of the Bollinger Band, if the price erupts upward and breaks through the upper end of the Bolling Band, and the expansion is likely to continue due to clustering.

2.The volatiity of the stock prices increases again, and since the initial shot was upwards, there is a chance that it will lead to a sharp rise in the price above the center line.

3.In other words, if the prices erupts upward after contraction and breaks the upper end of the Bollinger Band, it is a signal of a sharp rise and is generally known as a buy signal.

4.However, as shown in the picture, there are many cases where it temporarily returns to the halt again, so if you buy, it is better to buy in installment or wait and catch it as a surprise.