Volume basis

1.There are many different chart analysis methods and too few secondary indicators. No one sees all of this. However, there is absolutely no expert who does not look at trading volume.

2.Most technical indicators are lagging. However, trading volume has precedence.

3.Past trading volume also influences the direction of whether the price will rise or fall in the future, and the accumulation and distribution of power can also be inferred through trading volume.

4.It is very important because you can know the defense power of each item through the listing.

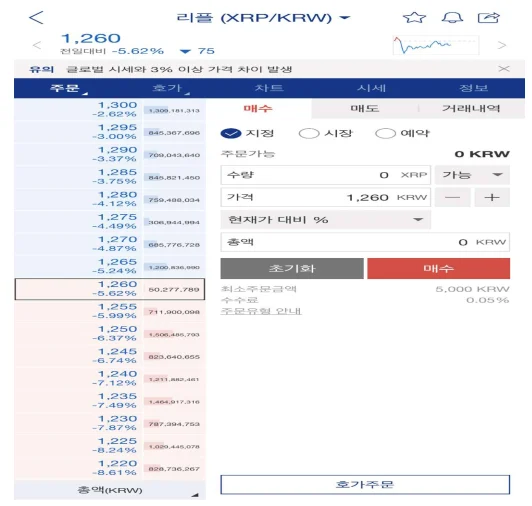

Understanding fastening systems

1.It’s a very basic part, but I’m telling you this because some people often don’t understand it.

2.Like stocks, the price of a coin is determined by the trading price at the quotation window.

3.As shown in the picture, buyers (red order window) and sellers (blue order window) call their desired purchase and sell prices.

4.In the situation shown in the picture, if I buy an item for sale at 1,260 won and the transaction is concluded, the current market price is 1,260 won.

5.If there is a lot of stock to buy and the stock continues to eat up all the stock to sell, and the selling price goes up, the price of the stock rises. Conversely, if there is a lot of stock to sell and the stock eats up all the stock to buy, the price goes down.

6.Designation means designating a certain point and buying or selling.

7.The market means that you will buy or sell immediately according to the market price.

8.If you make a reservation at the set monitoring price, that is, 50 won, and place an order at 48 won, if the item goes to 50 won, the order for 48 won will be activated.

9.It is best not to use pre-orders as the fees are high.

Volume Definition

1.If you look at the photo chart, there will be a trading volume or volume at the bottom (a square box with a white line).

2.Trading volume is displayed as the number of contracts concluded during the relevant time on the candle chart, and is displayed in the form of a histogram at the bottom of the candle.

3.The absolute number of transaction volumes may be important, but usually it is important to consider whether there has been a relative increase or decrease.

Preliminary purchase, provisional selling wall

1.The provisional purchase wall is the purchase amount set at a specified price in the bid window to prevent the market price from falling.

2.It is best to think of the sell-off wall as a layer that big players or forces have deliberately blocked to prevent the market price from rising.

3.Among altcoins, you can see that there is a large buying and selling wall.

4.In many cases, if there is a large buying wall, it will immediately fall, and if there is a large selling wall, it will immediately rise.

5.Some have buying and selling walls both up and down. This is one of three.

● When a bot is running to adjust the dollar price at the exchange level (this case is most common during normal times)

● Simultaneous installation of a temporary selling wall for buying at low prices (volume received from the lower buying wall below)

● In order to steal a large quantity at the highest possible price, a large hand holds a wall against the wall and steals the quantity from above.

6.Selling wall = Pumping: The main purpose is to accumulate quantity before flattening.

7.If you put up a selling wall, ants will sell because they don’t think the price will rise. Then I take everything from below and mainly pump.