Why is the crypto market down today?

The cryptocurrency market is down today, with the total market capitalization falling by 3.70% to $2.59 trillion on April 9 amid $250 million in crypto derivatives market liquidations.

Bitcoin , the largest cryptocurrency by market capitalization, led the decline by falling 4.12% to around $68,941 in the last 24 hours. Ether , the second-largest crypto, has dipped 4.63% to trade at $3,508 in the same period.

Let’s explore the reasons why the crypto market is down today.

Traders anxiously wait for U.S. CPI data

Crypto prices failed to sustain their recent bullish momentum ahead of the April 10 Consumer Price Index (CPI) print that is expected to come in higher than expected.

Commenting on the market reaction, CNBC analyst Sara Min said the release of U.S. inflation data scheduled for April 10 could spark a major move in risk assets as traders wait to see how the Federal Reserve will proceed with interest rates.

The March CPI reading is expected to see a 0.3% increase month-on-month and a 3.4% rise on a yearly basis, according to economists polled by Dow Jones. Core CPI, which excludes food and energy prices, is expected to climb by 0.3% and 3.7%, respectively.

Popular trader and analyst Daan Crypto Trades drew attention to macroeconomic events set for April 10 and 11, including CPI, PPI, Jobless claims and the ECB interest rate decision.

“The market has not been reacting a lot to these things lately, but I think they are still important to keep an eye on,” the analyst wrote.

A hotter CPI could mean a correction, while a cooler print could trigger a move higher, increasing the likelihood of a Fed rate cut in June.

The CME FedWatch Tool now sees a 42.3% possibility of keeping the Fed funds rate unchanged in June, while chances of a rate cut are at 56.2%.

Futures liquidations drive the crypto market lower

The decline in the prices of major cryptocurrencies has led to a rush of liquidations across the derivatives market. Bullish traders appear to have been caught off guard, leading to a quick spat of long liquidations.

In the past 24 hours, over $242.87 million in long positions have been liquidated across the crypto market, with $152 million wiped out in the previous 12 hours.

Asset prices are negatively affected when long derivative positions are liquidated without buying pressure from trading volume.

Over 83,164 traders were liquidated, with the largest single liquidation being Ether/USD on OKX, valued at $7.53 million.

Related: Bitcoin’s halving won’t see a 600% return this year — so adjust your strategy

The chart above shows that there are more liquidations on Ether than on Bitcoin. Daan Crypto Trades highlighted this phenomenon in an April 9 post on X, saying, “Every time ETH shows some kind of strength, the entire market tanks.”

Spot Bitcoin ETF outflows turn negative

The crypto market faces a market cycle different from previous bull runs. This can be attributed to the launch of spot Bitcoin ETFs and the upcoming Bitcoin supply halving.

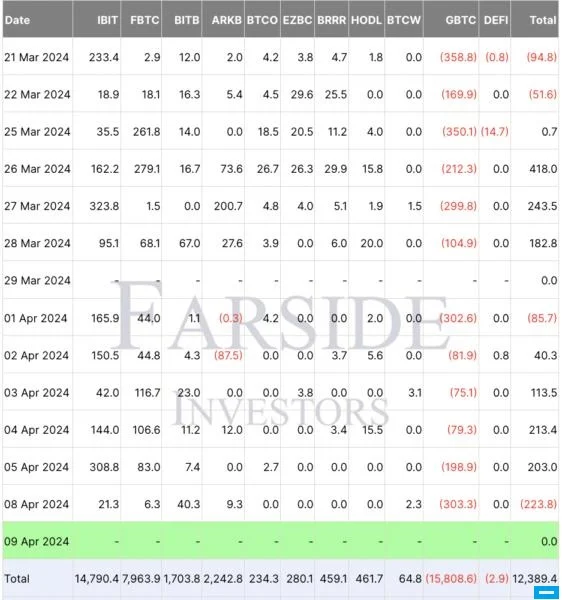

On March 27, the net capital flows into all the spot Bitcoin ETFs turned negative at $233.8 million, with Grayscale’s converted GBTC fund recording another day of outflows totaling $303 million, the highest over the last 10 days, according to data provided by Farside Investors.

Slowing Bitcoin ETF inflows indicates a decrease in investors’ risk appetite. In uncertain or bearish market conditions, investors might prefer holding cash or investing in more traditional and less volatile assets.

However, market participants remain optimistic about the crypto market’s upside potential before and after the Bitcoin halving event, which is less than 10 days away.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.